Solana (SOL/USD) was trading at $159 on Tuesday over 3% higher, which is almost 40% lower than the highest it reached in November. Solana fell over 10% on Monday, sliding to $150, which it last experienced in October, before starting the rally that pushed it to a new all-time high.

$150 is a very crucial support level for Solana and can be a make or break level. Therefore, this could be a great opportunity to buy Solana with its strong fundamentals. However, investors should be careful, as an early entry could prove to be very risky. Is now the right time to buy Solana?

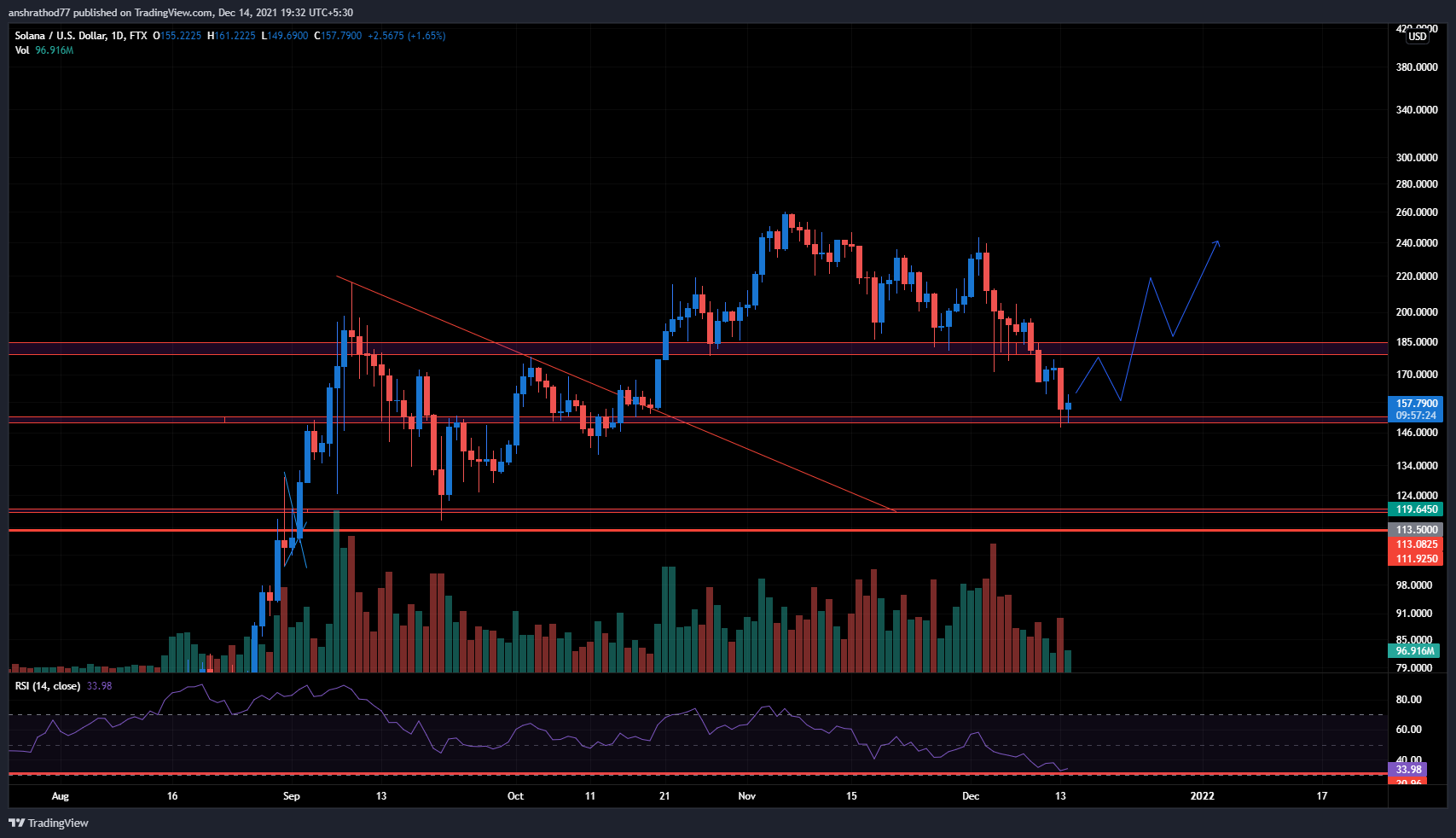

Here’s what the charts indicate:

-

Solana has fallen by over 40% and is now trading at a very important support level.

-

The support at $ 150 has previously proved to be very strong, which could indicate an early reversal and a rally.

-

Solana has very strong fundamentals, so the price is supported by investors from a certain point due to these fundamentals.

-

The RSI is also at its lowest point and is extremely close to the oversold zone, which indicates an imminent reversal, as banks could now return to the bank at any time.

-

All long entries below the $150 mark should be avoided, as Solana could fall to $125. Therefore, investors should only enter long entries if a clear reversal can be seen.

-

Solana formed a bullish hammer candle on Tuesday, indicating a reversal.

-

Investors can set the first target at $190, followed by $220 and finally a new all-time high in the coming months.

-

A stop loss can be set at $ 140.

The post Can the support at $150 be the turning point for Solana? appeared first on Coin Hero.