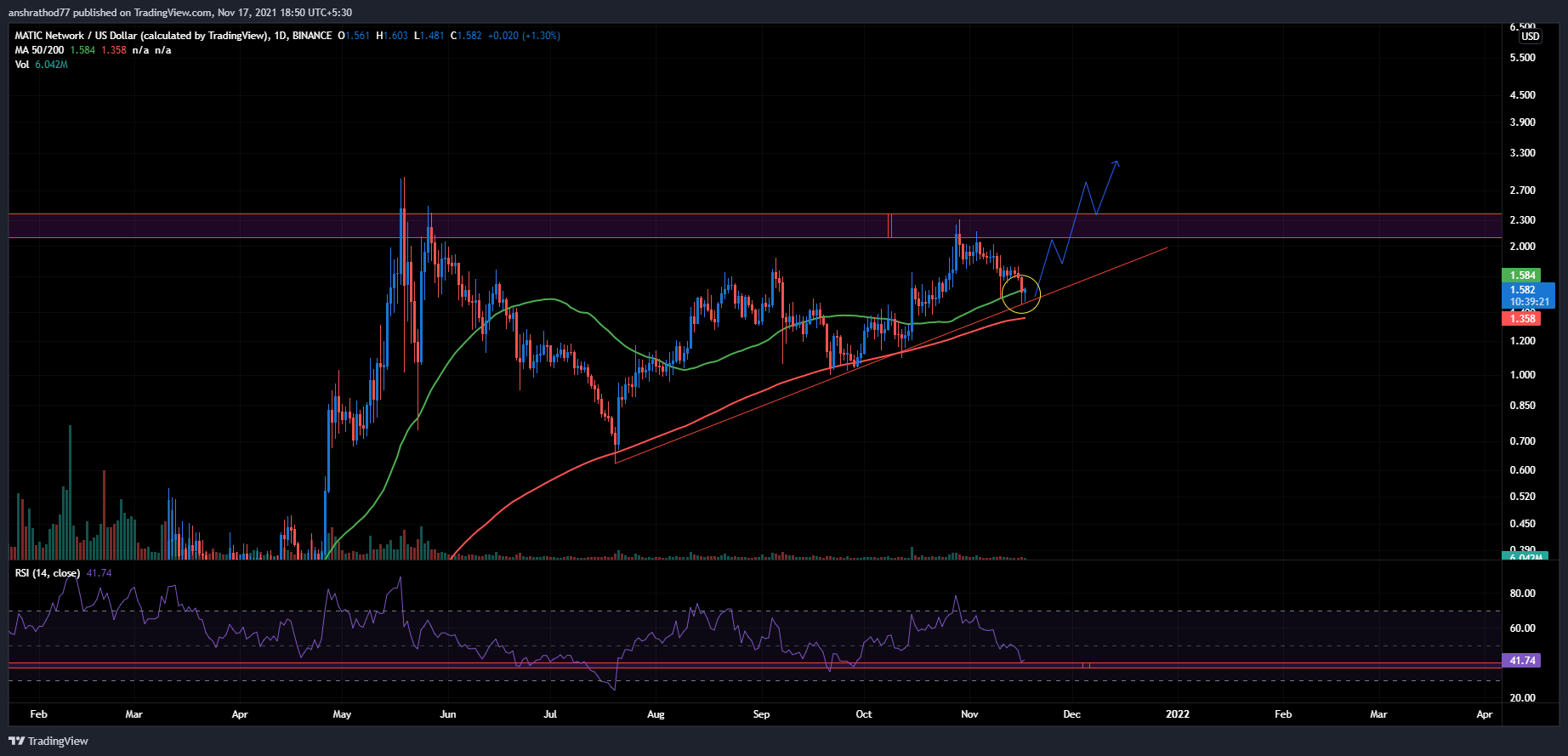

Polygon (MATIC/USD) has corrected by over 40% from its high of $2.3 at the end of October, but is now at the bottom of the trendline. The formation of bullish candles in the last 2 days suggests that the bulls will soon return to theü and Matic could start a new rally. This could be a great opportunity for investors who missed the previous rally. In addition, the situation would also be great for a buy-the-dip.

-

After reaching a high of $2.3, Matic has now fallen by over 40% to $1.46. However, on Wednesday, a strong candle formed at the bottom of the trend line, indicating that a reversal will be seen soon.

-

Matic is also fundamentally a big-type coin. Therefore, this slump could be a great opportunity for investors to enter at a lower price for long-term views.

-

Matic was also in the RSI demand zone on Wednesday and has started a slow increase, which indicates an early reversal.

-

Matic has broken through the 50-day moving average, which is a sign of Stärke. Investors can take long positions when Matic is able to hold above the 50-day moving average.

-

A stop loss can be held at $1.36 at the 200-day moving average, with targets at $2, followed by $2.45. A new all-time high could also be reached in the coming months.

Conclusion

The bulls could return to Matic because the correction looks like it will end soon. However, investors should wait for a clear reversal before taking a long position.

Is the correction of Polygon finally over? appeared first on Coin Hero.