After a huge market sell-off on Friday, Bitcoin (BTC/USD) was trading 8% lower, many coins were deep in the red and there were enormous sales volumes to be observed. Theta Token (THETA/USD) fell by over 13%. Investors now see this as an opportunity to buy the dip. However, investors should be careful, as this may not be the end of the sell-off. Numerous coins were traded in the red by more than 10%. Investors should be aware that they could fall even further, which is why long positions should be avoided until a clear turnaround is evident.

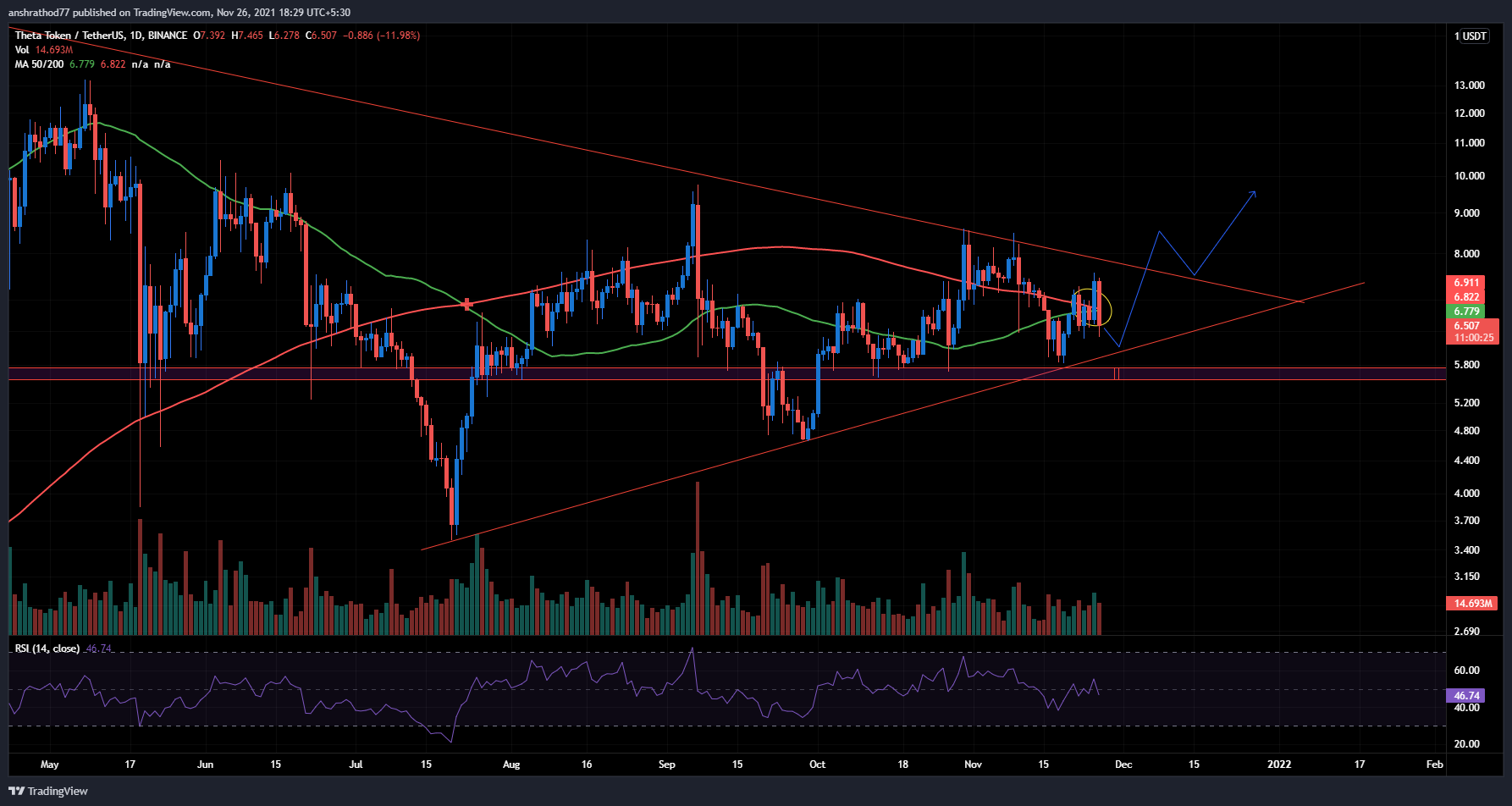

A look at the charts:

-

Theta formed a symmetrical triangle and tried to break out several times. After the slump on Friday, it looks like Theta is now testing the lower trendline.

-

Theta could soon test the lower trendline at $5.9. Should Theta be able to break out of this zone, there could be an upward breakout in the coming weeks.

-

Investors should be cautious and not get in too early, as Theta could still make a breakout to the downside. Therefore, long positions should not be taken until theta can bounce off the lower trendline.

-

The 50-day and 200-day moving averages are also on the verge of crossing. As soon as a golden crossover is seen, this could be an indication of a bullish recovery in the near future.

-

Investors who want a safer entry can enter as soon as Theta crosses the 200-day moving average, which is a bullish sign.

-

A target of $ 7.8 can be set. In the event of a breakout, a target of 8.7 USD could also be reached.

-

A stoploss can be set at $5.6.

Should you buy the dip of the Theta token on Friday? appeared first on Coin Hero.